This article presents the basics about the fixed asset setup in Dynamics AX 2012.

1/ Prerequisites

- Number sequences

- Access: Organization administration > Common > Number sequences > Number sequences

- Two number sequences must be created for the FA parameters:

- Automatic number for « Fixed asset number »

- Automatic number for « Fixed asset transfer »

-

One sequence per journal names: acquiring, depreciating, adjustment, …

-

Several number sequences per asset groups (optional).

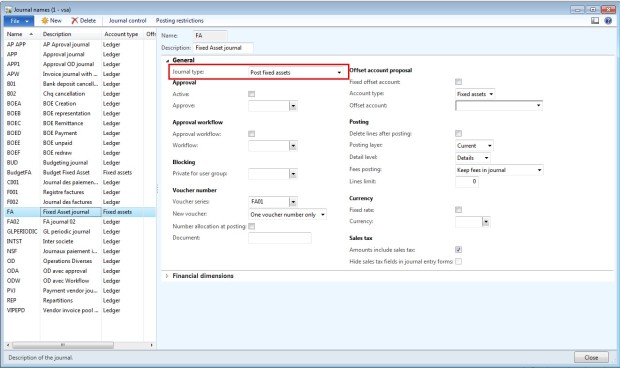

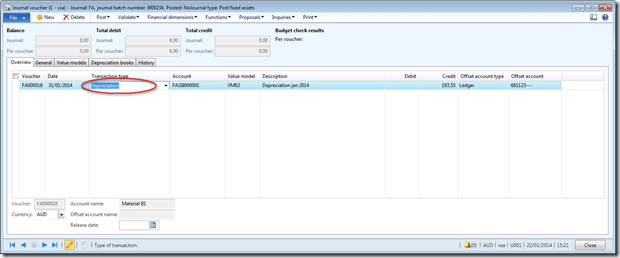

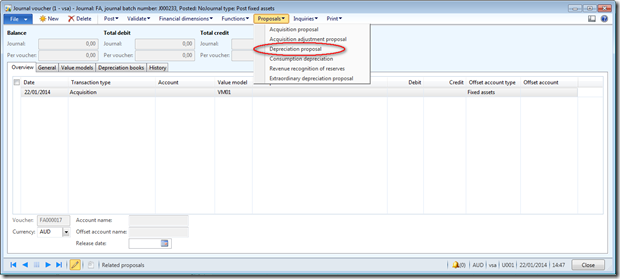

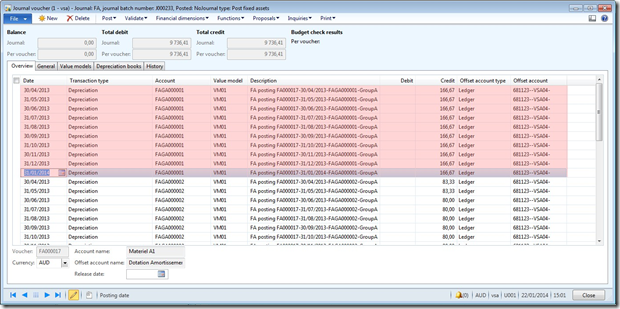

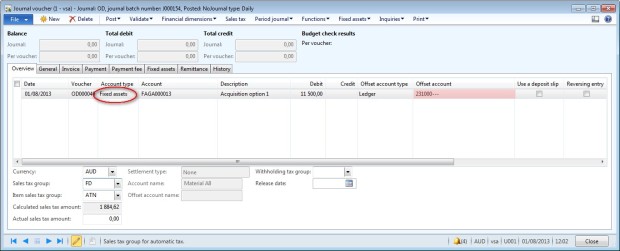

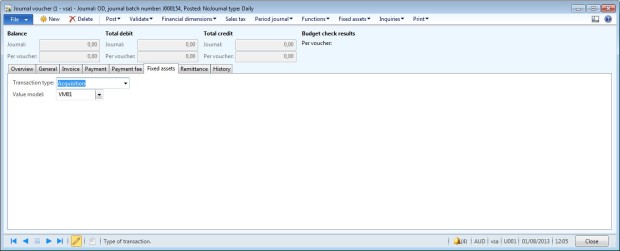

- Journal names

- Access: General Ledger >Setup > Journals > Journal names

-

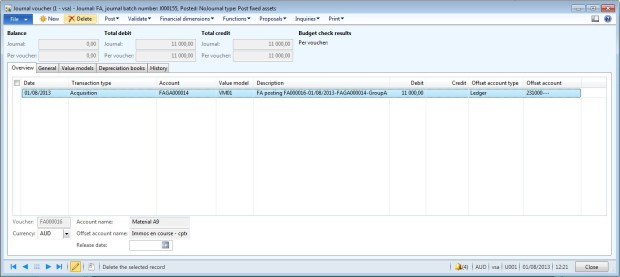

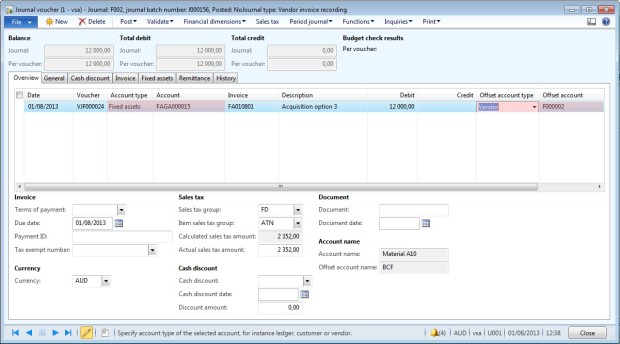

Create journal with the type « Post fixed Assets ».

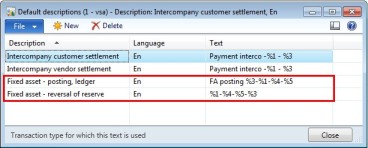

- Default descriptions

- Access: Organization administration > Setup > Default descriptions

-

Two default descriptions to setup :

-

Fixed asset – posting, ledger

-

Fixed asset – reversal of reserve

-

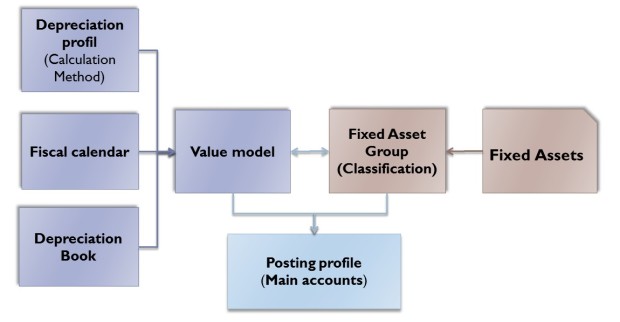

2/ Assets setup

- Depreciation profiles

- Fiscal calendar

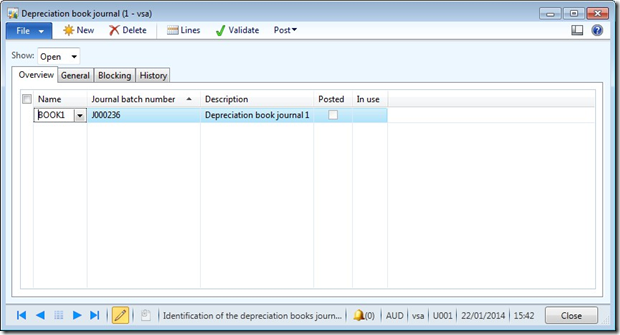

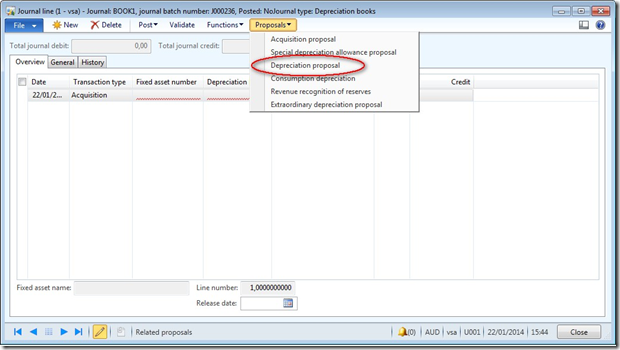

- Depreciation books

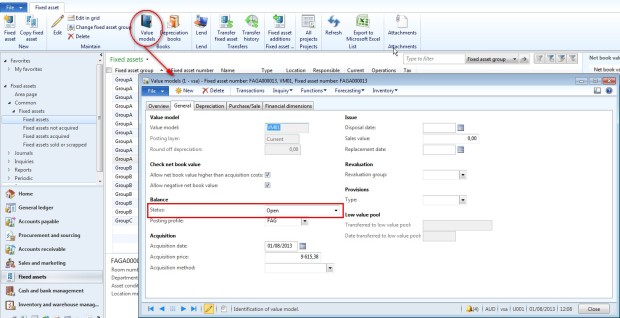

- Value models

- Fixed asset groups

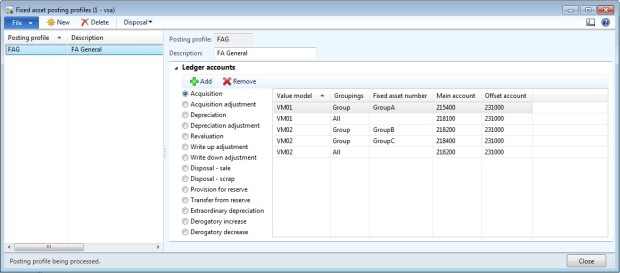

- Posting profiles

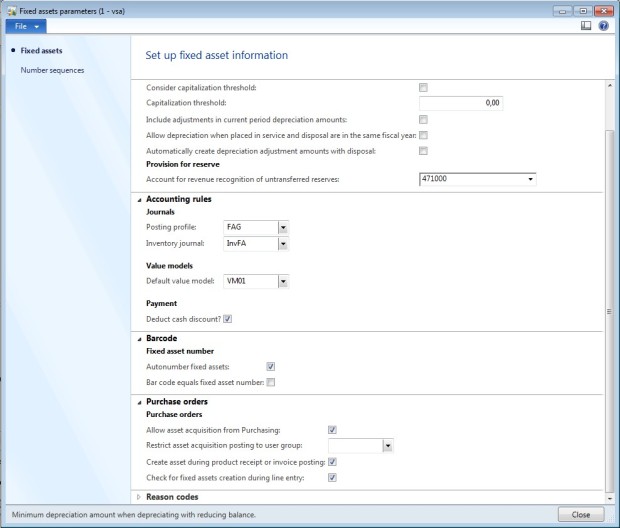

- Parameters

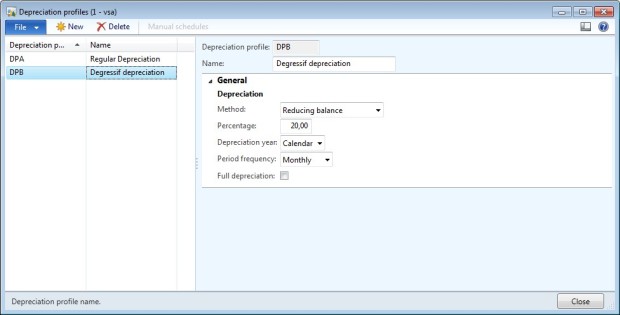

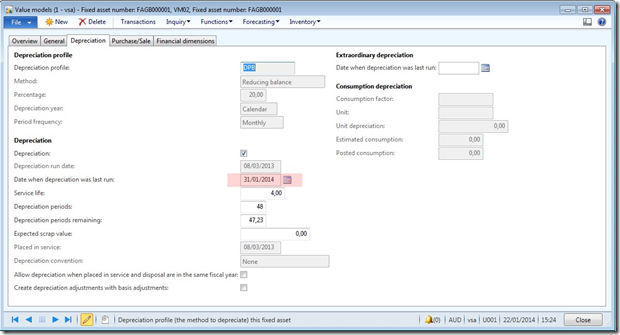

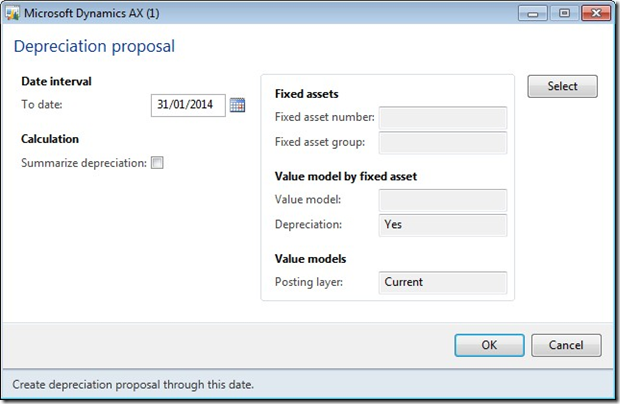

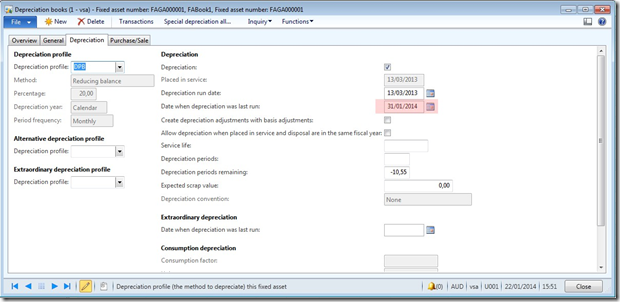

2.1/ Depreciation profiles

-

Create a new depreciation profile and enter a code and a name.

-

Select Method.

-

Field the percentage (depend of the method).

-

In the Depreciation year field, select Calendar or Fiscal.

-

Select the period frequency to define when the depreciation is posted.

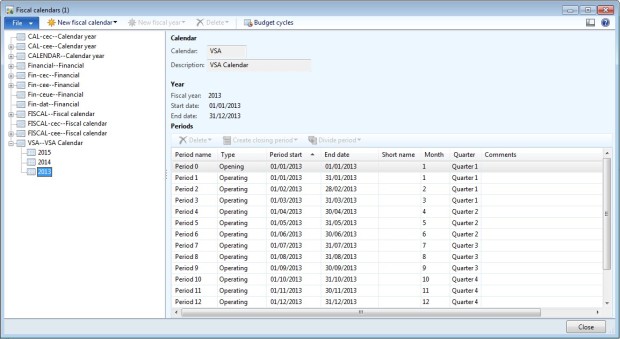

2.2/ Fiscal calendar

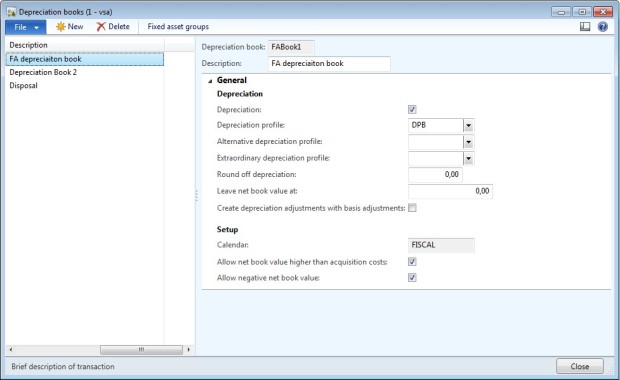

2.3 / Depreciation books

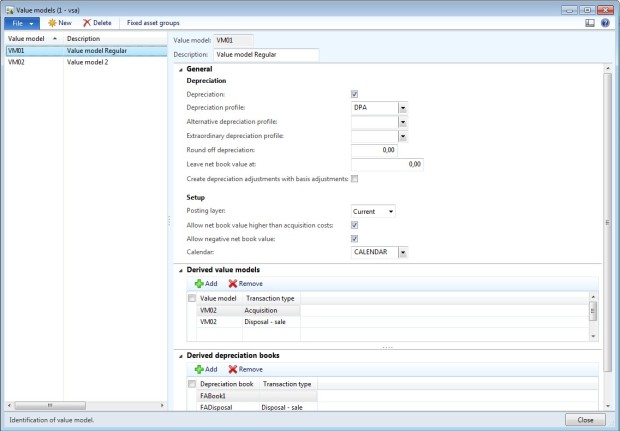

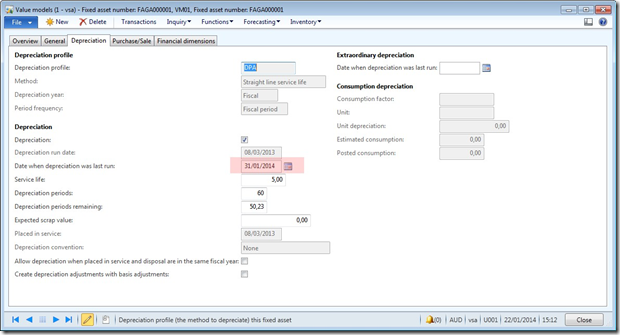

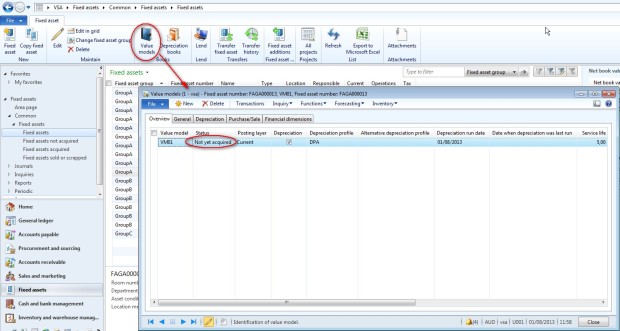

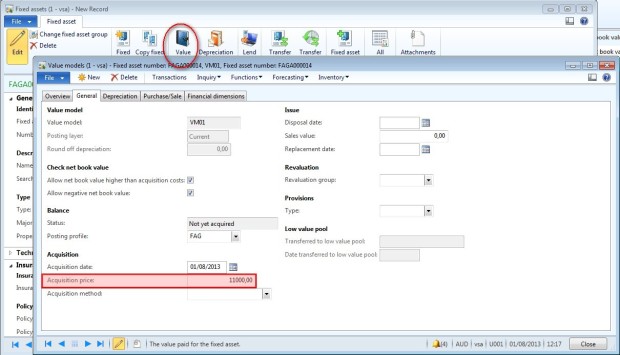

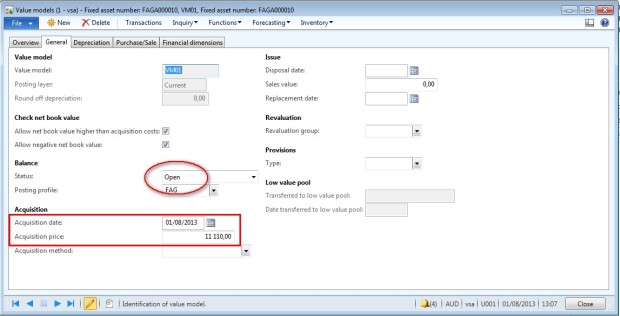

2.4/ Value model

- They contain and connect all financial information about Fixed assets.

- They achieve complete setup of depreciation for an asset.

- Each value model assigns an additional life cycle to the asset.

- Each asset can have an unlimited number of value models attached.

Access:FA > Setup > Value models

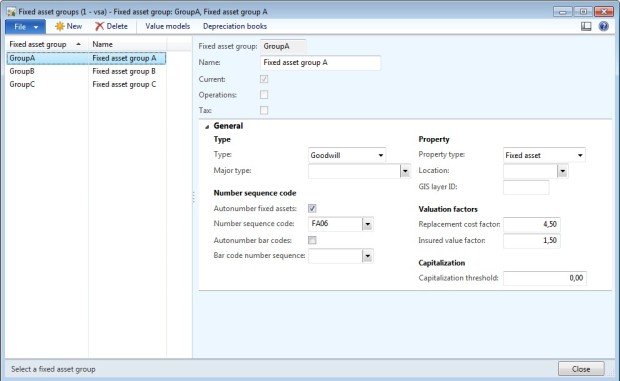

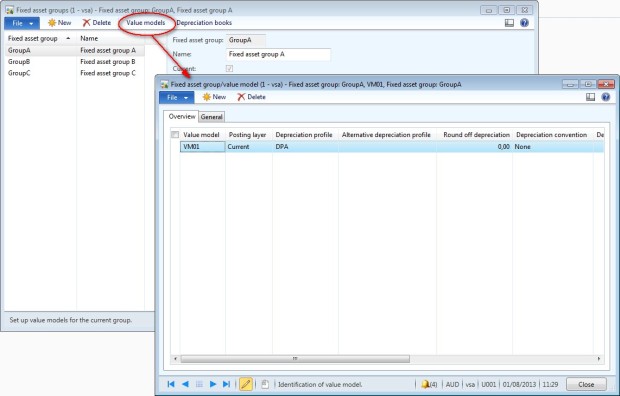

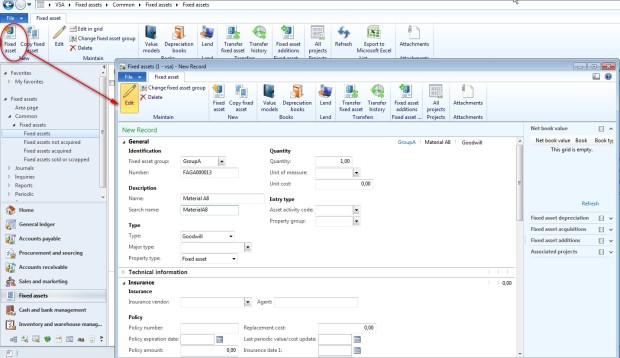

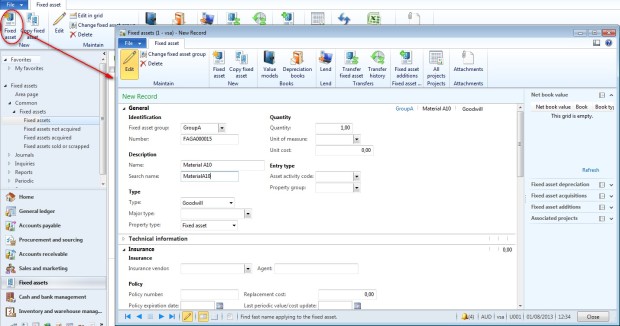

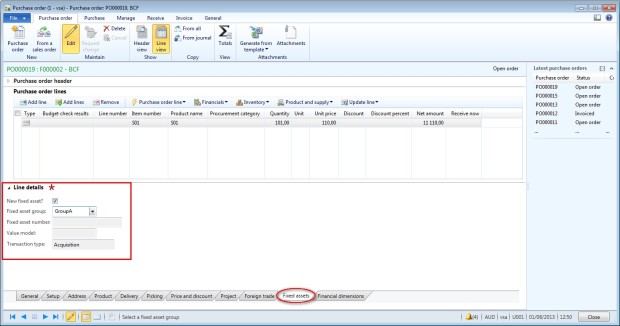

2.5/ Fixed assets groups

- To simplify the setup of assets

- To help inquiries, reporting, and setting up posting profiles

- To create a template with default information that is copied to a new asset when the company acquires a similar asset

- Access: FA > Setup > Major types